This article first appeared in Seattle Study Club’s Journal in 2019. It is written by CWA Partner Charles Loretto. If you have questions regarding EBITDA or other concepts, contact his team at cainwatters.com/contact.

With the significant increase in buy-out offers from Private Equity (PE) firms, many practice owners are considering selling their practice before they originally planned.

If everything is for sale for the right price, how is the “right price” determined for a practice?

This “right price” is not just a monetary sales price, but also takes into consideration the opportunity cost—which represents the benefits an individual, investor or business misses out on when choosing one alternative over another. When faced with a business offer, such as selling your practice, it should be used to make an educated decision when there are multiple options before you.

If we look more closely at opportunity costs, the right price should ultimately be the option that is likely to yield the greatest return over time, taking into account the potential one might give up with the accepted offer.

The right price and the right time is not the same for every practice and every doctor. In the following case study, I’ll walk through a couple of exercises that both the PE firms and financial services firms like CWA perform prior to giving or accepting an offer.

STEP 1: FIGURE OUT YOUR EBITDA

The goal of this step is to understand the whole financial benefit the doctor is receiving as an owner.

This is more than just the owner’s salary or taxable income, and includes other benefits such as pensions, meals, entertainment and other non-cash expenses like auto mileage that need to be recorded against one’s bottom line. This exercise is similar to the due diligence a bank would perform during a traditional valuation of your dental practice.

The best way to understand a PE firm offer is to figure out your EBITDA, which means your earnings before interest (EBI), taxes (T), depreciation (D) and amortization (A). National Dental Placements (NDP), our dental transition affiliate, refers to this exercise as the normalization of the business.

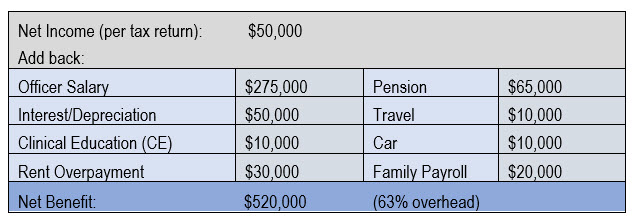

Below is an example of what this exercise may look like:

Example 1: General Practice—Collections of $1,400,000

Lets assume in this example, the doctor’s collections are $1,100,000 and hygiene produces the balance of $300,000.

Based on this example, here is how a PE firm will generally calculate the EBITDA:

The net benefit of $520,000 is the baseline and is then reduced by what the firm would pay the doctor to work back in the office following the sale. In this case we estimate this amount to be $300,000, which is the $1,100,000 of doctor collections multiplied by a standard compensation rate of 27% of collections.

This results in a $220,000 EBITDA that the PE firm will now multiply by a 5-7 multiplier number to arrive at the price they are willing to pay.

STEP 2: UNDERSTAND THE MULTIPLIER

How do PE firms determine what multiplier makes sense? They will look at risk factors unique to the practice to determine the appropriate multiplier.

Factors that could impact a multiplier could be location, finish out, patient flow or updated technology. If we assume in this example, that the multiple utilized is 6 then the offered price would be 6 times the $220,000 EBITDA and equal approximately $1,320,000, which is 94% of last year’s collections.

These multipliers are attractive to most because if this practice was valued using the industry standard dental valuation models (rather than the PE valuation method), it’s reasonable to assume the practice would sell for only 75-80% of collections or $1,120,000 (80% of collections) in our example.

STEP 3: CONSIDER THE NON-FINANCIAL REQUIREMENTS OF THE DEAL

Appealing multipliers and monetary offers are typically only one side of the deal. Other important factors to consider in these types of deals is the guaranteed work back that the seller will be required to commit to as part of the sale.

Industry standard is typically a minimum requirement of three years, however, we have seen requirements up to five years. This commitment may be undesirable or unachievable for some sellers depending on their personal situation.

Another facet of this kind of deal that does not get as much attention (but is very important), is the contingency and sale stipulations for payment.

We see in many deals with PE firms, the sellers do not receive 100% of the sale right away. These types of clauses offer a certain percentage now and the remaining percentage in the future. For example, the initial deal may be a sale of 60% of the practice at the 6 times earnings. What will happen to the remaining 40%? The theory is that the PE firm will then try to grow the organization buy purchasing and packaging together additional offices with the goal of selling to another company for profit.

This presents additional future uncertainly as one cannot anticipate the conditions of the next 40% sale. Consider a situation where the next buyer will want you to stay on another 3-5 years, just when you thought you were out. The offers moves from a straightforward $792,000 (60%) of the value today, with a salary of $300,000 to run the practice for at least 3-5 years, to a level of uncertainty that accompanies the value and time of the remaining 40% of the practice.

STEP 4: WEIGH THE OPPORTUNITY COST

When looking at the whole deal, it’s just as important to weigh what you are giving up by selling the practice, as it is the actual sale dollar amount.

In this example, if selecting this alternative, the doctor must consider the $220,000 reduction in annual income (different between the owner’s $520,000 net benefit versus the $300,000 of salary they would receive post sale) over the five-year period. Other owner benefits that they would give up with the sale should also be considered, such as business owner tax planning opportunities, pension plan contributions and the satisfaction many receive from key decision making and overall practice control.

In this first example, our team would likely advise the client against selling based on the estimated loss incurred over the five additional years, or if sold in a traditional outright private sale. Let’s look at another example, this time with a specialty practice.

Example 2: Orthodontic Practice—Collections of $3,000,000

This next example is an orthodontic practice that carries 50% overhead after normalization (EBIDTA calculation explained above). In this practice’s case, the PE Firm would likely offer the one-doctor owner to work back in the practice for two to three years at $300,000 per year, thus leaving $1,200,000 for EBITDA.

$1,200,000 at a 6 multiplier results in a $7,200,000 valuation. This particular PE firm has been paying 80% of the value upfront with the remaining balance paid at the end of the 2-3 years, with the same hope of the higher multiplier. With average valuations typically ranging from 70-85% of market price, this offer was 240%–which is hard to turn down.

Another difference in an orthodontic practice (versus a general dentist), is the ability of the orthodontist to complete all of the $3,000,000 of collections by him or herself. The overhead is also much lower which adds to the much higher EBIDTA.

Over the past year, CWA has had numerous orthodontists sell to PE firms under this type of model. Although each doctor’s opportunity cost is unique, CWA’s advisors typically support a sale when the value of the business is higher than the traditional market value, and the work back commitment is low. In our experience, based on these models, several practices have sold for more than eight times their EBIDTA.

CONCLUSION

There will always be practices where these PE models will make sense for both general and specialty practices—particularly those in which the associates do not want to buy-in under a traditional model, or when the practice has a very low overhead and therefore the EBITDA yields a much higher value. However, as of this article we have yet to see an offer by a PE firm make financial sense in the oral surgery, periodontics, and endodontic space.

In past times, the offer put on the table was final, with little room for negotiation. However, times are changing and we have seen increased room for negotiations due to the large number of firms that have entered the market in the last five years. There are investor and DSO conferences with regular attendees in the thousands, all wanting to enter this space and reap the financial benefits. PE firms are here to stay based on their recent success and at this time it’s hard to know how it will ultimately impact the industry.

Prior to accepting any offer to sell your life’s work, it is important to understand your personal financial plan and how the sale will both positively and negatively impact you. There are many considerations including time value of money, tax planning as the owner, pension planning, uncertainty with the second portion of the sale, loss of control, reduction of stress, and others that must be considered. A sale is more than what you get—it’s also what you miss out on.